Responding to Climate Change

We recognize that responding to climate change issues is not only a risk which could jeopardize corporate sustainability, but also an important management issue that leads to an expansion of profit opportunities. In November 2022, we agreed with TCFD※1 and decided to disclose "Governance," "Strategy," "Risk Management," and "Indicators and Targets" based on a medium to long-term perspective towards 2030/2050, in line with the recommendations published by TCFD.

※1 TCFD refers to the Task Force on Climate-related Financial Disclosures, which was established by the Financial Stability Board (FSB) at the request of G20. TCFD recommends that companies disclose items related to climate change risks and opportunities.

TCFD Website:https://www.fsb-tcfd.org/

Governance

We have established the promotion of environmental conservation as one of our sustainability priorities, and our Sustainability Committee oversees initiatives related to climate change. Our Sustainability Committee is chaired by the President and CEO with an outside director (vice-chairperson) and managers of relevant divisions (committee members). The committee promotes our sustainability measures and monitors the progress of these measures to ensure continuous improvement.

The Executive Committee receives regular reports from the Sustainability Committee on the status of activities and plans, discusses and decides on important issues related to climate change, and monitors progress.

The Board of Directors receives regular reports on important issues determined by the Executive Committee and provides instructions and supervision.

Structure for Sustainability Promotion

Strategy

After identifying our risks and opportunities for the impacts of climate change, we conducted our analyses on the possible impacts, reviewed our strategies in response to those scenarios, and verified our resilience.

The degree of financial impact on business is qualitatively assessed in three stages: large, medium, and small, as it is difficult to assess the business impact quantitatively at this point. While continuously analyzing scenarios to improve the accuracy of our financial impact analyses, we will strengthen our ability to respond to risks and opportunities associated with climate change and strive to raise the level of sustainability management.

Climate-related risks and opportunities, financial impact on our business

| Classification | Term | Our main risks | Degree of impact | Major opportunities for us | Degree of impact | |

|---|---|---|---|---|---|---|

| Transition | Policies and regulations | Medium |

|

Medium |

|

Small to medium |

| Medium and long |

|

Small | ||||

| Marketplace and technology trends | Short and medium |

|

Medium |

|

Large | |

| Short and medium |

|

Small |

|

Medium to large | ||

| Short and medium |

|

Small |

|

Large | ||

| Evaluation and reputation | Short and medium |

|

Medium |

|

Medium | |

| Physics | Chronic | Long |

|

Small |

|

Small |

| Acute | Long |

|

Medium to large | |||

| Long |

|

Medium to large | ||||

Adopted scenario:

- 4 °C scenario:IPCC/RCP8.5、IEA

- 1.5/2°C scenario:IPCC/RCP2.6、IEA

Time frame definitions:

Short-term:less than 3 years、Medium-term:3 to 10 years、Long-term:10 to 30 years

Countermeasures for risks

| Our main risks | Countermeasures |

|---|---|

|

|

|

|

|

|

|

|

Risk Management

In order to respond to various changes in the external environment related to climate change, our Sustainability Committee quantitatively analyzes and evaluates the financial impact of risks and opportunities in three stages: large, medium, and small, and considers countermeasures. Risks and opportunities that have a large financial impact are reported to the Executive Committee and the Board of Directors, and appropriate measures are deliberated and decided from the perspective of company-wide risk management. In this way, we promote strategies to minimize risks and maximize opportunities. Going forward, we will continue to strengthen governance and risk management in climate change.

Indicators and Targets

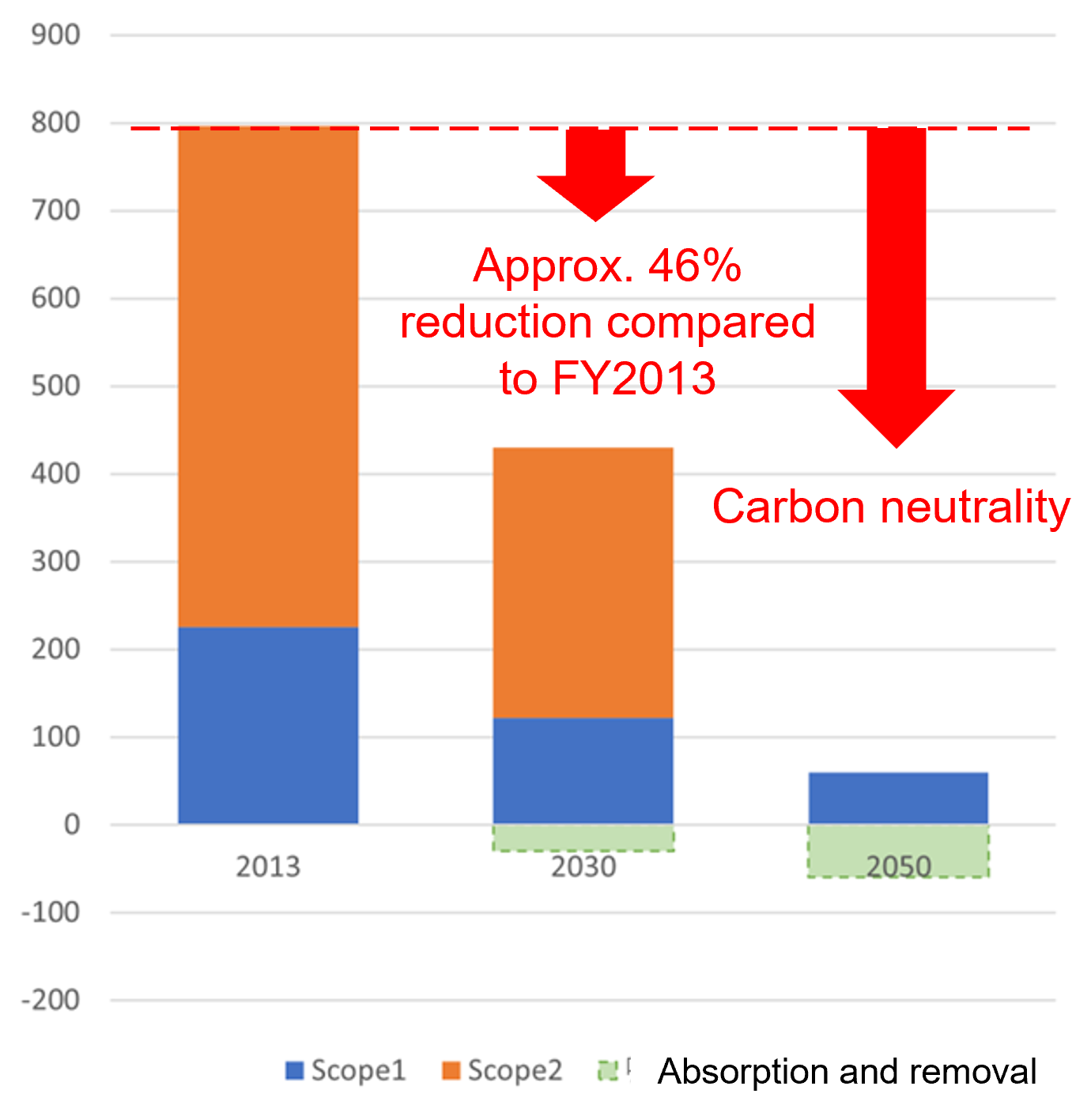

We have set a target of reducing greenhouse gas emissions related to Scope 1 and 2 by 46% in fiscal 2030 compared to fiscal 2013. At the same time, we are aiming to achieve carbon neutral emissions by 2050 based on the “Green Growth Strategy Through Achieving Carbon Neutrality in 2050” formulated by the Japanese government.

Greenhouse Gas Emissions

For fiscal 2024 results, please refer to the Greenhouse Gas Emissions section of the environmental data.

| Scope1 + 2 *Greenhouse-Gas Emissions Reduction Rate | Scope3 *Greenhouse-Gas Emissions Reduction Rate |

|---|---|

| FY 2030: 46% reduction compared to FY2013 FY 2050: Realization of carbon neutrality(virtually zero) |

In order to set targets, we will work to refine our calculations in the future. |

Notes

Scope 1: CO2 emissions from the use of fuels by the company itself

Scope 2: CO2 emissions from the use of electricity supplied by other companies

Scope 3: Indirect emissions other than Scope 1 and Scope 2 (emissions by other companies related to the company's activities)